|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

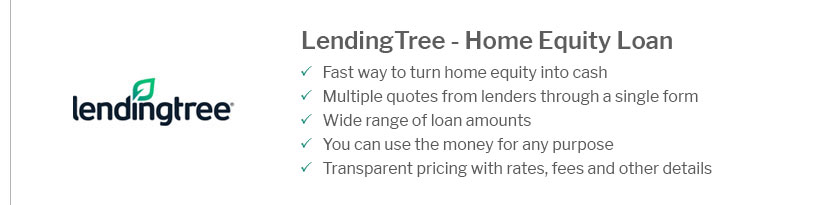

Best Loan for Remodeling Your Home: A Complete Beginner’s GuideHome remodeling can be an exciting yet daunting process, especially when considering the financial aspects. Choosing the right loan for your remodeling project is crucial to ensure you achieve your home improvement goals without unnecessary financial strain. Understanding Your Loan OptionsThere are several types of loans available for home remodeling. Each has its benefits and potential drawbacks, depending on your specific needs and financial situation. Home Equity LoanA home equity loan allows you to borrow against the equity of your home. It typically offers a fixed interest rate, making it a stable choice for many homeowners.

Home Equity Line of Credit (HELOC)A HELOC offers more flexibility than a traditional home equity loan by providing a revolving credit line.

Personal LoansPersonal loans are unsecured, meaning they do not require collateral. They can be a good option for smaller projects.

Factors to Consider When Choosing a LoanWhen deciding on the best loan for your remodeling needs, consider the following factors:

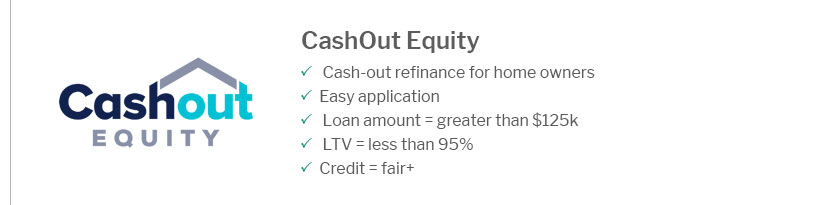

When to Consider RefinancingRefinancing can be a smart way to fund your remodel by potentially lowering your interest rate or changing your loan term. A 20 yr refinance might offer the balance between manageable monthly payments and reduced interest costs. FAQs About Remodeling LoansWhat is the best loan option for a kitchen remodel?The best loan option depends on your specific financial situation. A home equity loan or HELOC can be beneficial if you have significant equity in your home. For smaller projects, a personal loan may suffice. How does a HELOC work for home renovations?A HELOC provides a revolving line of credit that you can draw from as needed. You pay interest only on the amount you borrow, making it a flexible option for ongoing or multiple renovations. Can I use a personal loan for any type of remodeling project?Yes, personal loans can be used for any remodeling project. However, they usually have higher interest rates compared to secured loans, which can increase the cost of large projects. https://www.reddit.com/r/Mortgages/comments/1gbdthg/looking_for_advice_on_best_loan_type_for_a/

I would recommend either a HELOC or a fixed rate second lien. There are numerous factors on what is your best route, which include your current ... https://www.nerdwallet.com/best/loans/personal-loans/personal-loans-home-improvement

Some government programs can help pay for a home renovation. The Federal Housing Administration has two programs: Title I loans and Energy ... https://www.td.com/us/en/personal-banking/personal-loan/personal-loan-for-home-improvement

Home equity loans, like TD Bank's, are secured loans that let homeowners borrow against their home equity. Lenders call these second mortgages, and they accept ...

|

|---|